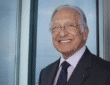

Warren Buffett: The Oracle of Omaha

Early Life and Education

Warren Edward Buffett was born on August 30, 1930, in Omaha, Nebraska, to Howard Buffett, a stockbroker and congressman, and Leila Stahl Buffett. From a young age, he exhibited a strong interest in business and investing. At just six years old, he began selling chewing gum, Coca-Cola bottles, and newspapers to earn money.

Buffett made his first investment at the age of 11, purchasing three shares of Cities Service Preferred stock. When he was a teenager, he filed his first tax return and even took a deduction for his bicycle, which he used for his newspaper delivery route. His early passion for finance and entrepreneurship set the foundation for his future success.

Buffett attended the University of Nebraska, where he completed his degree in business administration. He then pursued a Master’s degree in economics at Columbia Business School, studying under Benjamin Graham, the father of value investing. Graham’s principles of investing—focusing on undervalued stocks with strong fundamentals—had a profound influence on Buffett’s future strategies.

The Rise of Berkshire Hathaway

After working for Benjamin Graham’s firm, Buffett Partnership Ltd., he returned to Omaha and began investing independently. By 1965, he acquired a controlling stake in Berkshire Hathaway, a struggling textile company. Realizing the declining prospects of the textile industry, Buffett shifted the company’s focus toward investing in high-quality businesses.

Under his leadership, Berkshire Hathaway transformed into one of the most successful holding companies in the world. Buffett strategically acquired and invested in companies such as:

- Coca-Cola: Buffett purchased a significant stake in the company in 1988, recognizing its strong global brand and consistent growth.

- American Express: He invested in American Express in the 1960s after a financial crisis, proving his belief in value investing.

- Geico: Buffett was fascinated by Geico’s business model and eventually acquired the entire company.

- Apple: Despite initially avoiding tech stocks, Buffett later became a major investor in Apple, recognizing its strong brand and customer loyalty.

His investment strategy centers around buying businesses with strong fundamentals, competent management, and long-term potential. He famously stated, “Our favorite holding period is forever,” emphasizing his belief in long-term investments.

Wealth and Philanthropy

As of recent years, Warren Buffett has consistently ranked among the richest people in the world, with a net worth exceeding $100 billion. Despite his immense wealth, he is known for his frugal lifestyle. He still lives in the same modest home in Omaha, which he purchased in 1958 for $31,500. He prefers simple habits, like eating McDonald’s for breakfast and drinking Coca-Cola daily.

Buffett is also one of the most generous philanthropists in history. In 2006, he announced his plan to give away over 99% of his wealth to charity. He co-founded the Giving Pledge with Bill and Melinda Gates, encouraging other billionaires to commit to donating a majority of their fortunes to philanthropic causes.

Through the Bill & Melinda Gates Foundation and his own foundations, Buffett has donated billions of dollars to improve healthcare, education, and poverty alleviation around the world. His charitable contributions have made a significant impact on global welfare.

Investment Philosophy and Influence

Warren Buffett’s investment approach is based on value investing, a strategy that involves identifying undervalued companies with strong long-term potential. Some of his most famous principles include:

- “Be fearful when others are greedy, and greedy when others are fearful.”

- “Price is what you pay; value is what you get.”

- “The stock market is designed to transfer money from the Active to the Patient.”

Buffett’s annual shareholder letters to Berkshire Hathaway investors are widely regarded as some of the best financial wisdom available. He has mentored thousands of investors through his writings and speeches, influencing financial markets and business leaders worldwide.

Legacy and Lessons from Buffett

Warren Buffett’s legacy extends far beyond his wealth. He has revolutionized the investment world, demonstrating that patience, discipline, and integrity are key to financial success. His story serves as an inspiration for investors, entrepreneurs, and philanthropists alike.

His ability to simplify complex financial concepts has made investing accessible to people worldwide. Whether through his legendary stock picks, his ethical business practices, or his commitment to philanthropy, Warren Buffett remains a true icon in the world of finance.

As he once said, “Someone is sitting in the shade today because someone planted a tree a long time ago.” His lifelong contributions to investing and society ensure that his influence will continue for generations to come.