Gilead Sciences, Inc.: Pioneering Antiviral Therapies for Global Health

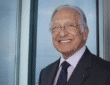

Gilead Sciences, Inc., founded on June 22, 1987, in Foster City, California, is a leading American biopharmaceutical company dedicated to researching and developing innovative antiviral drugs. With a focus on critical health issues, Gilead specializes in treatments for HIV/AIDS, hepatitis B and C, influenza, and COVID-19, notably developing medications such as ledipasvir/sofosbuvir and sofosbuvir. Under the leadership of CEO Daniel O’Day since March 2019, the company employs approximately 18,000 people and continues to play a pivotal role in global health advancements.

Founding and Growth of Gilead Sciences

Gilead Sciences, Inc. was founded in June 1987 by Michael L. Riordan in Foster City, California, originally under the name Oligogen. Riordan, a medical doctor with degrees from Washington University, Johns Hopkins, and Harvard Business School, developed the idea during a research project at Menlo Ventures. With the help of scientific advisers, including Nobel laureates Harold Varmus and Jack Szostak, Gilead focused on antiviral medicines after Riordan contracted dengue fever. The company moved to Vintage Park in 1988 and began developing small molecule antiviral therapeutics in 1991, in-licensing compounds like tenofovir. Despite initial struggles and limited income, Gilead’s focus on innovation laid the groundwork for its future success in the biopharmaceutical industry. The name “Gilead” was inspired by the Balm of Gilead, linked to Riordan’s readings during medical school. In its early years, Gilead narrowly avoided bankruptcy, with Riordan prioritizing the company’s financial stability.

History of Gilead Sciences

Foundation

Gilead Sciences was founded in June 1987 by Michael L. Riordan in Foster City, California, originally under the name Oligogen. Riordan, a medical doctor with degrees from Washington University, Johns Hopkins, and Harvard Business School, developed the idea during a research project at Menlo Ventures. His scientific advisers included notable figures such as Peter Dervan, Doug Melton, and Harold M. Weintraub.

Initial Investment and Focus

Menlo Ventures made a $2 million investment in Gilead, which primarily focused on antiviral medicines. Riordan’s interest in this field was sparked after he contracted dengue fever. He successfully recruited prominent individuals to the board, including Donald Rumsfeld, and initially attempted to involve Warren Buffett.

Research Direction

Gilead’s early research concentrated on developing antisense therapy using small strands of DNA to target specific genetic sequences. Riordan envisioned the name “Gilead Sciences” from his medical school readings of Lanford Wilson’s play Balm in Gilead, ultimately securing the name after a $1,000 donation to a nonprofit using “Gilead.”

Headquarters and Growth

By 1988, Gilead established its headquarters in Vintage Park, Foster City, and began developing small molecule antiviral therapeutics in 1991, including the nucleotide compound tenofovir. Riordan faced significant challenges during the company’s first decade, often narrowly avoiding bankruptcy and prioritizing financial stability.

1990–1999: Initial Public Offering and Early Growth

IPO and Early Developments

- 1992: Gilead debuted on NASDAQ, raising $86.25 million.

- 1996: Launched Vistide for CMV retinitis in AIDS patients.

- 1997: Donald Rumsfeld appointed chairman; left in 2001 upon becoming U.S. Secretary of Defense.

Acquisitions

- 1999: Acquired NeXstar Pharmaceuticals, expanding its product portfolio with AmBisome and DaunoXome.

Licensing Agreement

- 1999: Licensed Tamiflu to Roche for development, addressing limitations in Gilead’s market access.

2000–2009: Focus on Antivirals and Expanding Portfolio

Antiviral Strategy

- 2001: Viread approved for HIV treatment.

- 2002: Shifted corporate strategy to focus exclusively on antivirals; sold cancer assets.

Major Acquisitions

- 2002: Acquired Triangle Pharmaceuticals for $464 million, gaining emtricitabine.

- 2004: Acquired Corus Pharma, entering the respiratory market.

- 2006: Acquired Myogen for $2.5 billion, solidifying its position in pulmonary diseases.

- 2009: Acquired CV Therapeutics for $1.4 billion, enhancing its cardiovascular franchise.

2010–2019: Major Acquisitions and Product Launches

Key Developments

- 2010: Acquired CGI Pharmaceuticals and Arresto Biosciences to enhance research capabilities.

- 2011: Acquired Pharmasset for $10.4 billion, solidifying leadership in hepatitis C treatment.

- 2012: FDA approved Truvada for HIV prevention (PrEP).

Additional Acquisitions

- 2017: Acquired Kite Pharma for $11.9 billion, entering the cell therapy market.

- 2019: Announced donation of Truvada for free to 200,000 patients annually for 11 years.

2020 Onwards: Strategic Acquisitions and New Ventures

Recent Acquisitions

- 2020: Acquired Forty Seven Inc. for $4.9 billion; reached a merger approach with AstraZeneca.

- 2020: Acquired Immunomedics for $21 billion, gaining Trodelvy for cancer treatment.

- 2021: Added to Dow Jones Sustainability World Index.

Ongoing Developments

- 2022: Pulled Zydelig from accelerated approval; acquired MiroBio for $405 million.

- 2023: Completed acquisition of Tmunity Therapeutics through Kite Pharma; announced acquisition of XinThera.

- 2024: Acquired CymaBay Therapeutics; paid Genesis Therapeutics $35 million for AI drug discovery work.

Acquisition History

Gilead Sciences Acquisitions

- Pharmasset Acquisition (2011): Gilead acquired Pharmasset for $11 billion, gaining the hepatitis C drug sofosbuvir. This acquisition is often cited as one of the best in the pharmaceutical industry.

Treatments for Hepatitis C

- Sovaldi Approval (2013): Sofosbuvir, marketed as Sovaldi, received FDA approval as a hepatitis C treatment, resulting in significant market impact.

- Sales Performance: Forbes ranked Gilead as the fourth-largest drug company, with a market capitalization of $113 billion and a stock appreciation of 100%. Analysts projected Sovaldi sales would reach $53 million in late 2013.

- Pricing Controversy: In 2014, the U.S. Senate investigated the drug’s high price of $1,000 per pill, leading to discussions about market pricing and access. Sovaldi was later offered at significantly lower prices in poorer countries, with generic options available in India for as low as $4.29.

- Combination Therapies: Gilead developed single-pill combinations, such as Harvoni (sofosbuvir and ledipasvir), which has a cure rate of 94% to 99% for HCV genotype 1. Other combinations include Epclusa and Vosevi.

Financial Performance

- Fiscal Year 2017: Gilead reported earnings of $4.628 billion and revenue of $26.107 billion, reflecting a 14.1% decline compared to the previous year. As of October 2018, the company had a market capitalization of $93.4 billion.

| Year | Revenue (in million USD) | Net Income (in million USD) | Total Assets (in million USD) | Price per Share (in USD) | Employees |

|---|---|---|---|---|---|

| 2005 | 2,028 | 814 | 3,766 | 9.77 | – |

| 2006 | 3,026 | -1,190 | 4,086 | 14.31 | – |

| 2007 | 4,230 | 1,585 | 5,835 | 18.30 | – |

| 2008 | 5,336 | 1,979 | 6,937 | 22.74 | – |

| 2009 | 7,011 | 2,636 | 9,699 | 21.32 | – |

| 2010 | 7,949 | 2,901 | 11,593 | 18.15 | – |

| 2011 | 8,385 | 2,804 | 17,303 | 18.46 | – |

| 2012 | 9,702 | 2,592 | 21,240 | 26.13 | – |

| 2013 | 11,202 | 3,075 | 22,579 | 51.83 | 6,000 |

| 2014 | 24,890 | 12,101 | 34,664 | 82.82 | 7,000 |

| 2015 | 32,639 | 18,108 | 51,716 | 98.83 | 8,000 |

| 2016 | 30,390 | 13,501 | 56,977 | 78.87 | 9,000 |

| 2017 | 26,107 | 4,628 | 70,283 | 70.13 | 10,000 |

| 2018 | 22,127 | 5,455 | 63,675 | 63.86 | 11,000 |

| 2019 | 22,449 | 5,386 | 61,627 | – | 11,800 |

| 2020 | 24,689 | 123 | 68,407 | – | 13,600 |

| 2021 | 27,305 | 6,225 | 67,952 | – | 14,400 |

Prospects for the Future

- Challenges and Opportunities (2017): Gilead aims to develop or acquire new blockbuster drugs as revenue from existing products declines. With $32 billion in cash (of which $27.4 billion is overseas), the company is exploring strategies for repatriating funds and leveraging its cash reserves for potential acquisitions.

- Research Advances: Gilead’s Entospletinib has demonstrated a 90% complete response rate for MLL type acute myeloid leukemia (AML), highlighting its focus on expanding its treatment portfolio.

This structured summary provides an overview of Gilead Sciences’ key milestones and current financial standing while addressing its strategies for future growth. Let me know if you need further adjustments!

Criticisms

1. TAF Development Delays

- Mass Tort Lawsuits: Gilead faces multiple lawsuits alleging it delayed the development of antiretroviral drugs based on tenofovir alafenamide fumarate (TAF) to maximize profits from older medications containing tenofovir disoproxil fumarate (TDF).

- Suspension of TAF: The company reportedly suspended TAF development in 2004, despite evidence indicating TAF’s safety advantages over TDF, which was linked to nephrotoxicity and bone density loss.

- Patient Impact: The first TAF medication, Genvoya, was launched in 2015, leading to claims that many HIV patients suffered severe side effects while using older TDF-based drugs.

2. Pricing Controversies

- Sovaldi Pricing: Gilead faced criticism for pricing its hepatitis C drug Sovaldi at $1,000 per pill ($84,000 for a standard course) in the U.S., while offering it at significantly lower prices in developing countries (e.g., $4.29 in India). This led to a national debate on drug pricing.

- Senate Investigation: An investigation by the U.S. Senate Committee on Finance revealed that Gilead set high prices with minimal regard for research and development costs, which led to treatment rationing among Medicaid patients.

3. Truvada and Descovy Pricing

- Truvada for PreP: Introduced in 2004, Truvada’s price rose from $1,200 per month in 2012 to up to $2,000 by 2018, while costing less than $100 outside the U.S. In 2018, Gilead reported over $3 billion in Truvada sales.

- Activist Backlash: Activist groups criticized the high prices, leading to a Congressional hearing in 2019. Gilead later announced it would donate enough Truvada for up to 200,000 patients annually.

- 340B Drug Pricing Program: In July 2021, Gilead announced cuts to reimbursements for clinics serving low-income communities, hindering their ability to provide treatment.

4. Anticompetitive Behavior

- Pay-for-Delay Agreements: Gilead was accused of entering agreements to delay the release of generic versions of Truvada, leading to lawsuits from CVS Pharmacy and RiteAid.

- Generic Licensing: In response to pricing criticism, Gilead licensed generic production rights in India but included anti-diversion provisions that restricted access for vulnerable populations.

5. Tax Structures and Tax Avoidance

- Criticism of Tax Practices: Gilead has been criticized for using legal tax avoidance strategies to minimize tax burdens through transfer pricing, where profits are shifted to lower-tax jurisdictions.

- Double Irish Arrangement: A 2016 report indicated Gilead avoided up to $10 billion in taxes through this mechanism, shifting profits through an Irish entity.

- Repatriation of Funds: In 2018, Gilead repatriated $28 billion from its Irish subsidiary, paying an estimated $5.5 billion in taxes.

This summary encapsulates the main criticisms directed at Gilead Sciences, providing a clear picture of the challenges and controversies surrounding the company. Let me know if you need further adjustments or additional information!

Remdesivir Overview

1. Orphan Drug Designation

- Date: March 23, 2020

- Purpose: Gilead obtained orphan drug designation from the FDA to encourage the development of remdesivir, aimed at treating diseases affecting fewer than 200,000 Americans.

- Benefits: This designation grants extended legal monopoly rights, tax waivers, and government fee exemptions.

2. Role in COVID-19 Treatment

- Candidate Status: Remdesivir became a candidate for treating COVID-19 as case numbers rose rapidly in the U.S.

- Patents: Gilead holds 20-year patents for remdesivir in over 70 countries.

- Revenue: In 2021, remdesivir (marketed as Veklury) generated over $4.5 billion, making it Gilead’s highest-selling product.

3. Emergency Use Authorization

- Date: May 1, 2020

- Approval: Emergency use authorization was granted for hospitalized patients with severe COVID-19.

- WHO Guidance: In September 2020, the WHO recommended against using remdesivir, citing insufficient evidence of benefit at that time.

4. Clinical Evidence and Approval

- Further Research: Between 2020 and 2022, additional studies indicated that remdesivir reduced death rates and the need for oxygen or mechanical ventilation in hospitalized patients.

- FDA Approval:

- October 2020: Approved for hospitalized adults and children (12 years and older).

- January 2022: Expanded approval for non-hospitalized adults and children (12 years and older, weighing at least 40 kg) at high risk for severe COVID-19.

- Emergency Use for Children: Granted for children under 12 with mild-to-moderate COVID-19 who are at high risk.